Markets don’t move in one direction forever—different sectors perform better at different stages of the economic cycle. This is where sectorrotation comes in. By shifting investments from one sector to another, investors can take advantage of changing economic conditions and maximize returns. For both long-term investors and active traders, understanding sectorrotation is a powerful way to stay ahead in the market.

What Is Sector Rotation?

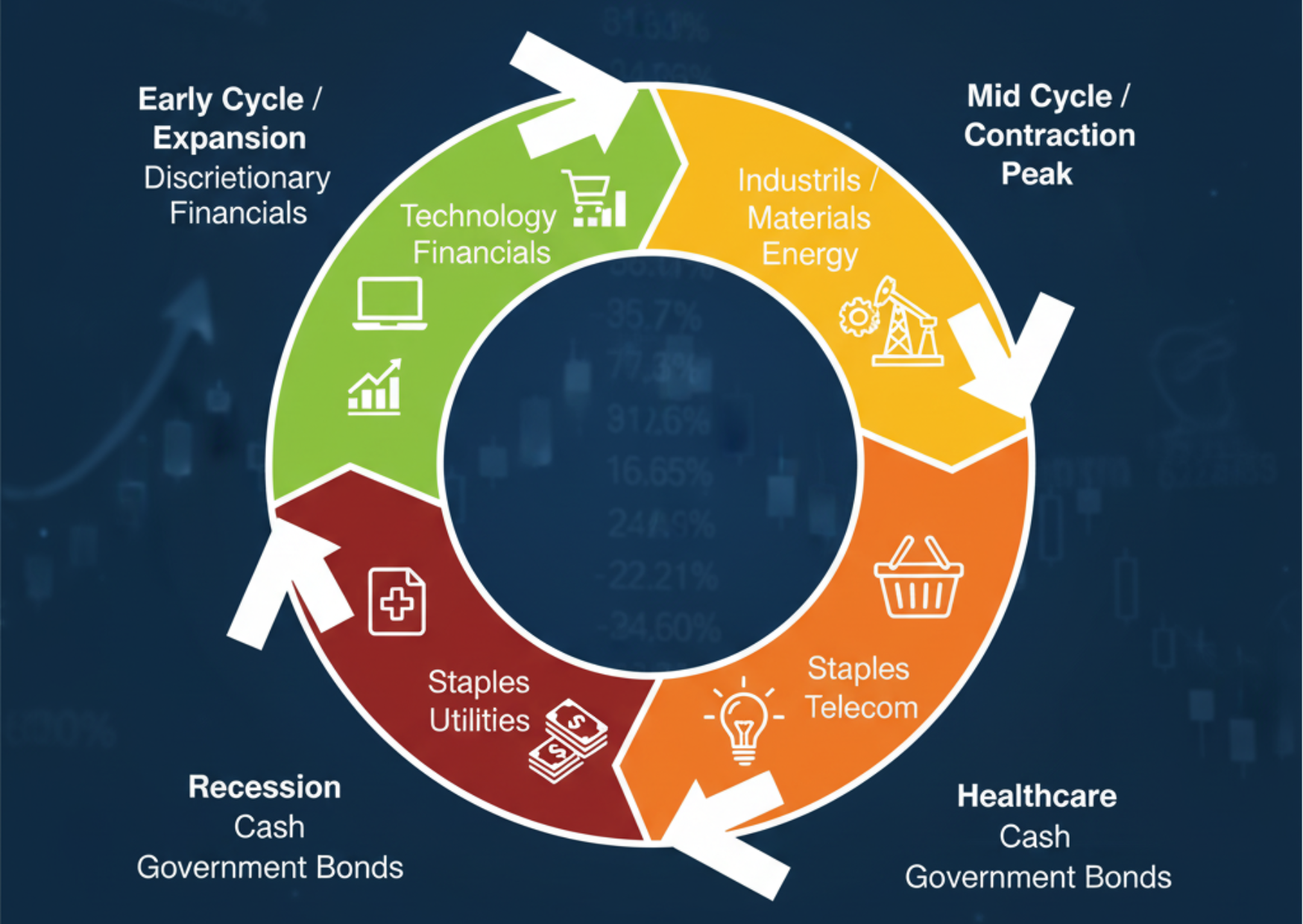

Sector rotation is an investment strategy that involves reallocating money between different sectors of the economy based on where we are in the business cycle.

For example:

- In an economic recovery, technology and consumer discretionary stocks often outperform.

- In a slowdown, utilities and healthcare are considered safer bets.

The idea is simple: follow the money where growth and stability are most likely.

Why Sector Rotation Matters

- Maximize Returns: Ride the strongest sectors instead of being stuck in underperformers.

- Risk Management: Defensive sectors help protect your portfolio during downturns.

- Adaptability: Adjusts your portfolio to changing market conditions.

- Diversification: Balances growth and stability across sectors.

Phases of the Market Cycle & Best Performing Sectors

1. Early Expansion

- Economy starts growing after a slowdown.

- Best Sectors: Technology, Industrials, Consumer Discretionary.

2. Mid-Cycle Growth

- Strong earnings, low inflation, stable growth.

- Best Sectors: Financials, Technology, Energy.

3. Late Expansion

- Rising interest rates, inflation concerns.

- Best Sectors: Energy, Materials, Commodities.

4. Recession / Contraction

- Slow growth, job cuts, falling demand.

- Best Sectors: Utilities, Healthcare, Consumer Staples.

How to Apply Sector Rotation in Your Portfolio

- Track Economic Indicators: GDP growth, interest rates, inflation trends.

- Use ETFs: Sector-specific ETFs (like IT, Banking, Pharma) make rotation easier.

- Follow Relative Strength: Compare sector performance against benchmarks.

- Stay Flexible: Don’t hold on to a sector once its momentum fades.

Risks of Sector Rotation

- Timing the Market: Misjudging cycles can lead to losses.

- Transaction Costs: Frequent reallocation may increase costs.

- Over-Dependence: Ignoring fundamentals can be risky.

Conclusion

Sector rotation helps investors align their portfolios with market cycles, ensuring they are always in the strongest-performing sectors. While it requires discipline and research, it’s an excellent way to manage risk and capture growth opportunities.

👉 Want to learn practical sectorrotation strategies with expert guidance? Join NiveshpathShala and start building smarter portfolios today.