When it comes to valuing a company, few methods are as widely respected as the Discounted Cash Flow (DCF) model. By estimating the present value of future cash flows, investors can determine whether a stock is undervalued or overvalued. Understanding DCF helps you move beyond speculation and into rational, data-driven investing.

What is DCF?

Discounted Cash Flow (DCF) is a valuation method that calculates the present value of a company’s expected future cash flows, adjusted by a discount rate. Simply put, it tells you how much a company is worth today, based on how much money it will generate in the future.

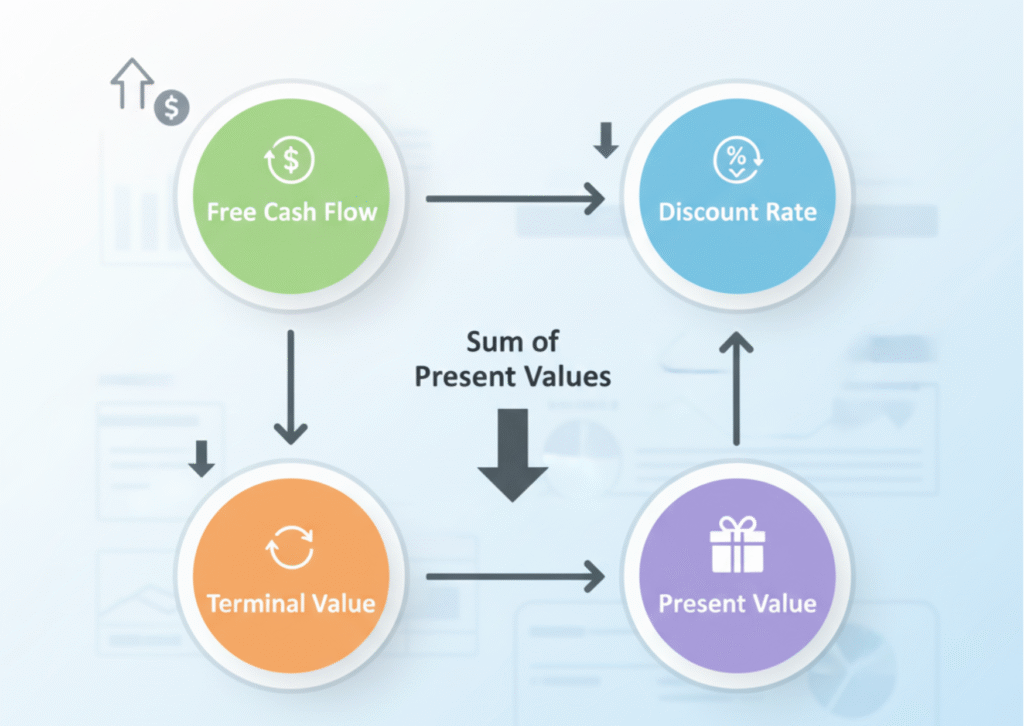

Key Components of DCF Analysis

- Free Cash Flow (FCF)

- The cash a company generates after accounting for capital expenditures.

- Formula: FCF = Operating Cash Flow – Capital Expenditure

- Forecasting Period

- Typically 5–10 years of future cash flows are estimated.

- Terminal Value

- Represents the value of the company beyond the forecast period.

- Two common methods: Gordon Growth Model or Exit Multiple.

- Discount Rate

- Usually based on the company’s Weighted Average Cost of Capital (WACC).

- Accounts for risk and time value of money.

- Present Value Calculation

- Future cash flows + terminal value are discounted back to today’s value.

Steps to Perform a DCF Analysis

- Project the company’s future free cash flows.

- Choose an appropriate discount rate (WACC).

- Calculate the present value of each year’s cash flow.

- Estimate the terminal value.

- Add the discounted cash flows + terminal value = Intrinsic Value.

- Compare with current market price to decide if the stock is undervalued or overvalued.

Why DCF Matters for Investors

- Provides an intrinsic value rather than relying only on market sentiment.

- Helps avoid overpaying for overhyped stocks.

- Encourages long-term thinking rather than short-term speculation.

- Can be adapted for companies, projects, or even startups.

Limitations of DCF

- Accuracy depends heavily on assumptions (growth rates, discount rate).

- Small errors in forecasts can lead to big differences in valuation.

- Not always reliable for companies with unstable or unpredictable cash flows.

Conclusion

The Discounted Cash Flow (DCF) model is one of the most powerful tools in a value investor’s toolkit. While it requires careful assumptions and research, it gives a clear picture of what a company is truly worth.

👉 If you want to learn practical valuation techniques and master tools like DCF, you can join Niveshpath Shala and start your journey toward becoming a smarter investor.